Bottoms Up: Implementing Alcohol Policies to Raise Revenue and Protect Health

This blog provides an overview of published learnings from alcohol policies, building upon a webinar series hosted by the Domestic Resource Mobilization (DRM) Collaborative under the Joint Learning Network for Universal Health Coverage.

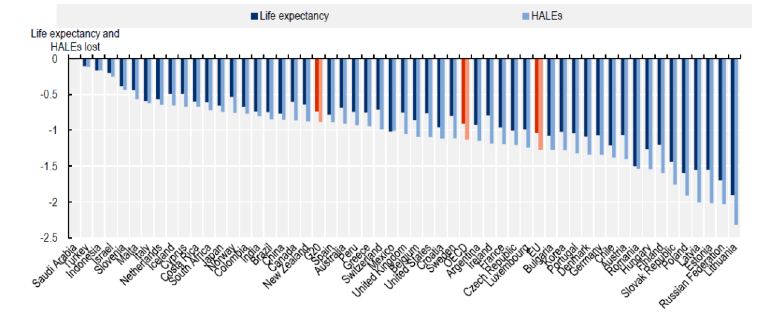

Over 2.3 billion people globally currently drink alcohol, consuming an average of 33 grams of pure alcohol per day. In parts of Eastern Europe and sub-Saharan Africa, over 60 percent of current drinkers engage in heavy episodic drinking, consuming at least 60 grams of pure alcohol at least once a month. The health consequences of the harmful use of alcohol are significant. About 3 million deaths and 132.6 million disability-adjusted life-years are lost to injuries, non-communicable diseases, and mental health conditions as a result. The recently released report by Economic Co-Operation and Development (OECD) Report on Preventing harmful alcohol use (2021) estimates that life expectancy in 52 countries would be a year higher if alcohol consumption were below recommended limits[1] (Figure 1). Moreover, during the COVID-19 pandemic, drinking behaviors and associated harms have increased in some cases, with a rise in the volume and frequency of consumption and domestic violence.

Figure 1: The impact of alcohol consumption on life expectancy

Source: OECD

The economic cost of harmful alcohol use is equally high. About 2.4 percent of health care spending is allocated to conditions caused by harmful alcohol drinking in the European Union (EU), Group of 20 countries, and the OECD. The productivity losses that result from premature death and disability from harmful alcohol use in these countries are equivalent to an estimated 2.2 percent of Gross Domestic Product.

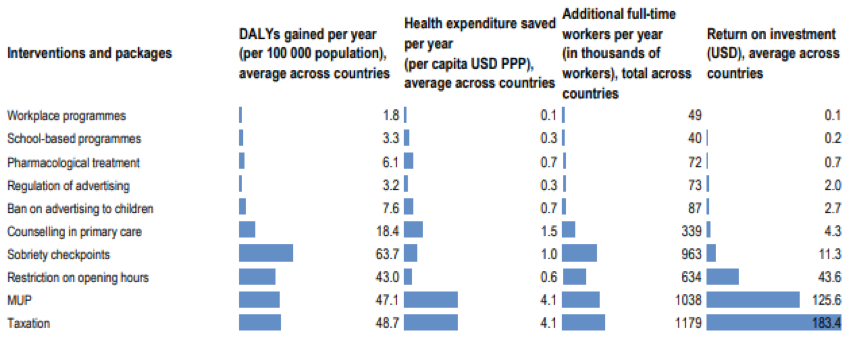

Policies that limit harmful alcohol consumption can improve population health, reduce health care spending, and increase workforce productivity while generating significant returns on investment (Figure 2). Considering the fiscal pressures that have resulted from the COVID-19 pandemic, alcohol taxes also offer a means for raising domestic revenue and expanding fiscal space for health. Despite the potential wins, there are significant gaps in alcohol policies, particularly in low-and-middle-income countries. By 2016, only 15 percent of low-income countries had formally adopted written national alcohol policies.[2] While 95 percent of all countries have alcohol excise taxes, fewer than half of them adjust these taxes to keep up with inflation and income levels.

Figure 2: The potential return on investment for alcohol policies in OECD countries, 2020-2050

Source: OECD

The Joint Learning Network for Universal Health Coverage (JLN) jointly hosted a discussion with the Sustainable Financing for Health Accelerator, the Global Financing Facility, and the World Bank Health Financing Global Solutions Group to examine the case for alcohol policy reforms in low-and-middle-income countries. The aim was to explore alcohol taxation as a way to boost population health and expand fiscal space as part of the recovery from the COVID-19 pandemic, while facilitating progress towards Universal Health Coverage (UHC). The webinar also offered peer-to-peer country exchanges on the design and implementation of alcohol policy, highlighting experiences in Ghana, Estonia, India (Andhra Pradesh), and the Philippines.

Key takeaways:

While participants voted alcohol taxation as the most effective means of reducing consumption, the discussion endorsed the need for a multimodal strategy to alcohol policy. A multimodal strategy is exemplified by the PPPP approach described in the OECD report. This approach includes Police enforcement to limit alcohol-related injuries and violence, Protecting children from alcohol promotion through regulations on social media, strengthening Primary care to help patients with harmful drinking patterns, and Pricing policies to limit the affordability of cheap alcohol. A microsimulation exercise with 48 countries estimated that 8.5 million cases of alcohol-related conditions and USD 28 billion could be saved every year if this approach is implemented.

Philippines spotlighted alcohol taxes as a potential tool for enabling progress towards UHC. The 2012 sin tax reforms raised and earmarked health taxes, leading to a tripling of the health budget and facilitating expansions in coverage. In 2019, a study commissioned by the legislative assembly estimated that alcohol consumption costs the Philippines an estimated P200 billion annually, leading to the approval of a bill that further increased taxes on beer and other alcoholic drinks. The Philippines experience illustrated the potential prominent role of civil society, including youth coalitions, in advocating for increases in alcohol and tobacco taxes and swaying public opinion in favor of these reforms.

Alcohol policy discussions in Ghana are also motivated by health concerns, however it also represents a case of lost opportunity where the political economy failed to leverage alcohol taxation as an apparatus to counter the increasing NCD problems in the country. While, the Philippines has focused on taxation, Ghana is also considering integrating health promotion into primary care to reduce harmful alcohol use.

The discussion on Estonia illustrated the need for regional harmonization of pricing policy to reduce harmful alcohol consumption. Between 2004 and 2010, excise taxes on alcohol were progressively increased by 45 percent, driven predominantly by economic factors and a preference for consumption taxation over income taxation. In 2015 and 2016, alcohol excise taxes rose by 15 percent, and increasingly, improving public health became the primary driver of further tax hikes. However, price differences with other EU countries, including Latvia, and the resulting cross-border trade significantly reduced the inflow of excise duty and value-added taxes into the state budget. The unfortunate result has been a race to the bottom with reductions in alcohol excise taxes in both countries.

The experience of Andhra Pradesh in India illustrates that the harmonization of alcohol policy is also essential within countries. Andhra Pradesh has an oscillatory trajectory with alcohol bans, implementing and reversing the prohibition of alcohol sales at various points. Akin to the Philippines, there was a prominent role for civil society (women movements) in advocating for alcohol policy. However, difficulties in ban enforcement and the diversion of alcohol revenue to neighboring states that had fewer restrictions motivated this policy’s reversal. Andhra Pradesh subsequently instituted an increase in excise alcohol taxes, constituting more than a third of total state revenues. However, alcohol consumption has not reduced as much as was expected. Participants noted that this illustrates a potential threshold beyond which alcohol taxes alone may not be effective a reducing consumption and thus, the need for a multimodal strategy that combines pricing and other policies.

Overall, the engaging seminar highlighted that alcohol policy offers multiple wins to countries, including reductions in preventable disability and death, increases in labor force productivity, expansions in fiscal space for health, and decreases in curative health care spending. However, the exchange also illustrated the importance of comprehensive strategies on lines of the PPPP approach beyond silver bullets, the role of civil society in advocating for policies to reduce harmful alcohol use, and the need for mechanisms that harmonize alcohol policies across subnational and national borders.

Authors:

Adanna Chukwuma, Vrishali Shekhar, Seemi Qaiser, Aditi Nigam, Danielle Bloom, Somil Nagpal, Ajay Tandon, Kate Mandeville

* This blog provides an overview of published learnings from alcohol policies, building upon a webinar series hosted by the Domestic Resource Mobilization (DRM) Collaborative under the Joint Learning Network for Universal Health Coverage. Contributions from the DRM Collaborative team led by Ajay Tandon, country members of the DRM Collaborative, and from Michael Borowitz and other members of the Global Fund team as the co-organizers of the webinar series are gratefully acknowledged. The authors represent a mix of presenters, facilitators and authors of referenced publications.

[1] OECD (2021), Preventing Harmful Alcohol Use, OECD Health Policy Studies, OECD

[2] The presence of a written national alcohol policy is a key indicator of a country’s commitment to reducing alcohol-related harm (WHO, 2010). National alcohol policies may be either separate documents or part of a broader public health policy – such as on substance abuse, noncommunicable diseases or mental health. Ideally, these policies will be well-funded, will establish clear leadership, will clearly indicate the responsibilities of the sectors involved and will set attainable objectives, strategies and targets (WHO, 2010).”

Wow, fantastic blog layout! How lengthy have you ever been running a blog for?

you make running a blog glance easy. The total look of your site is wonderful,

let alone the content material! You can see similar here dobry sklep