Earmarking in Ghana: Impacts on the Financial Sustainability of the National Health Insurance Scheme

By Daniel Asare Adin-Darko 1

Costal Development Authority (CODA) in Ghana registering citizens within the costal belt onto the NHIS in 2020.

In 2003, Ghana’s National Health Insurance Scheme (NHIS) was established using a set of unique earmarked funding sources to help move the country toward Universal Health Coverage (UHC). This funding provided a critical source of domestic revenue that allowed Ghana to remove its previous “cash and carry” system of paying for health services and implement one of the best-known public insurance schemes in the region.

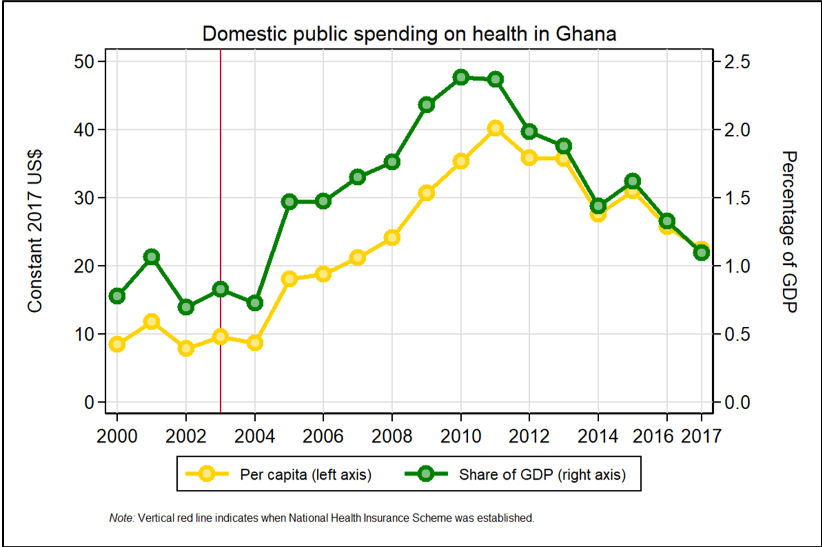

Although the reforms enabled the formation of the NHIS and led to an initial increase in domestic public spending for health, fiscal gains declined over time, slowing down the overall impact and additionality of resources (both per capita and as a share of GDP; see Figure 1). [i] Additionally, while the earmarked funds provide on average 91 percent of NHIS’s funding and 26 percent of resources for public programs in the health sector, Ghana continues to face financial sustainability challenges including increasing costs of medical claims due to rising population coverage of the scheme and utilization of health services, delays in the release of funds and inadequate expenditure controls. As such, the NHIS began experiencing financing deficits in 2009, utilizing investments to finance the gap.[ii]

| Table 1. Indicators | ||

| Population (thousands) | 29,767 | |

| Life expectancy (years) | 64 | |

| Fertility rate | 4 | |

| Human Capital Index (HCI) score | .45 | |

| GDP per capita (current US$) | 2,826 | |

| Current health spending (CHE) | Per capita (US$) | 78 |

| Share of GDP (%) | 4 | |

| Share of CHE (%) | ||

| Domestic government | 39 | |

| External health expenditure | 12 | |

| Social Health Insurance (SHI) | 11 | |

| Out-of-pocket | 38 | |

| GGHE- D (% GGE) | 6 | |

| Share of total government expenditure (%) | Health | 6 |

| Education | 19 | |

| Military | 2 | |

Sources: Health expenditure data from WHO Global Health Expenditure Database (2018); other data from World Development Indicators (2018) and Human Capital Index (2020)

Note: Data in Table 1 downloaded on April 15 2021. HCI score from September 2020 includes measures of survival, education, and health. See HCI for further details.

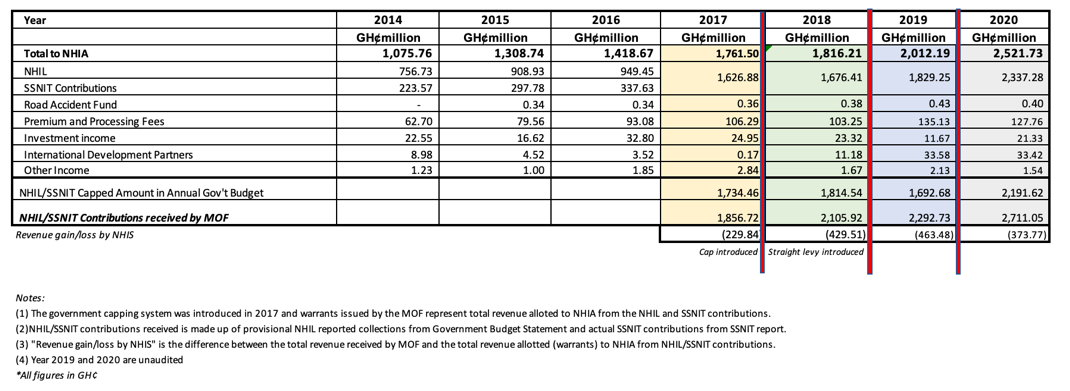

New reform initiated in 2018—namely the decoupling of the National Health Insurance Levy (NHIL) from the Value-Added Tax (VAT), which made it a straight levy on the consumption tax—changed the structure of one of the initial earmarks to provide potential revenue gains for the NHIS. However, a separate capping system introduced in 2017 limited the amount of revenue that could flow to the NHIS and weakened the potential of the new reform to support Domestic Resource Mobilization (DRM) for health. This resulted in NHIS recording a total revenue shortfall of about GH₵1.5 billion (US$302.89 million) from 2017 to 2020.[iii]

Figure 1. Domestic Public Funding on Health per Capita and as a share of GDP, 2000–2017

Source: Author’s calculation using data from WHO Global Health Expenditure Database.

1. Structure of NHIS.

Established through the National Health Insurance Act of 2003 (Act 650), the NHIS evolved as a result of political motivation to remove the previous “cash and carry” system of health care financing and move away from overreliance on out-of-pocket payments. The Act established the National Health Insurance Authority (NHIA, the managing body of the NHIS), the Council (the governing body or the Board of the Authority), and the National Health Insurance Fund (NHIF) (see Section 2). Since then, a single-payer system has been established through the new National Health Insurance Act, 2012 (Act 852). The passage of Act 852 replaced Act 650, made District Mutual Health Insurance Schemes (DMHIS) and NHIA one body to help harmonize activities, and injected some efficiency into the NHIS. DMHIS that had autonomously operated within districts—managing the enrollment, budget preparation, and claims of health care providers as independent legal entities with their own board of directors—became branches of the National Health Insurance Authority. Consequently, enrollment evolved into a national registry with biometric ID cards issued for members to access care across the country, to ensure full portability. District budgets were incorporated into the NHIA’s national budget as one entity, and a consolidated premium account was created.

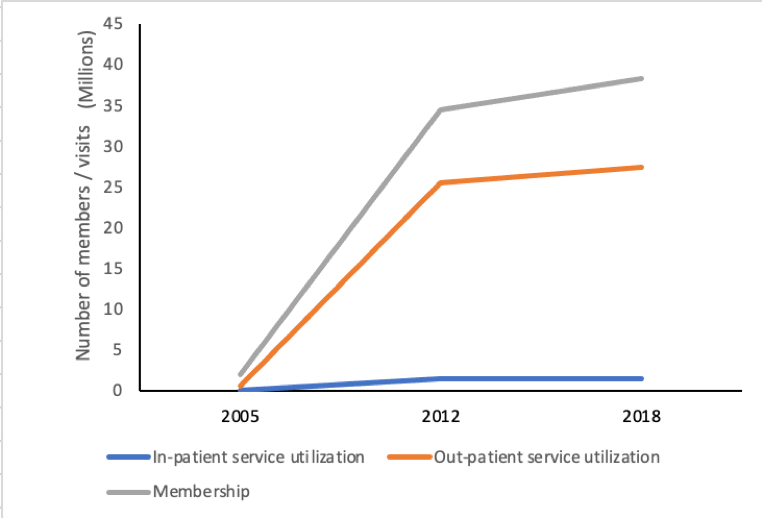

In the NHIS, membership is mandatory but enrollment is voluntary: members must enroll annually, leading to challenges in service utilization and access as well as disparities in enrollment because of financial constraints which can impact vulnerable populations.[iv],[v],[vi] Despite this, utilization rates—especially of outpatient services— are strongly correlated with enrollment and have increased steadily since 2005 (Figure 2). Enrollment in NHIS increased from 1.3 million people in 2005 to 8.9 million people in 2012. As of 2018, NHIS was operational in 163 districts across the country with a population coverage of 36 percent (10.8 million people), up from 6 percent in 2005.[vii] . The NHIS membership coverage of the population rose to 41 percent (12.29 million people) at the end of 2019. One factor that likely contributed to the increase in membership in 2019 is the introduction of mobile membership renewal in December 2018 where NHIS members are able to renew their membership anywhere using money from their mobile phone wallets without having to go to the NHIA District Offices for the renewal, which comes with transportation cost, opportunity cost and other inconveniences.

Figure 2. Growth in Membership, Inpatient and Outpatient Service Utilization 2005–2018

Source: NHIA Statistical Bulletin 2019.

Note: There is not a 1:1 relationship between utilization/number of visits at health facility and registration as individuals registered as members may use services multiple times within the year.

The Minister of Health under Section 30 (1) of the National Health Insurance Act, 2012 (Act 852) also established a benefits package, which covers about 95 percent of the most commonly occurring disease conditions in Ghana. The package includes inpatient and outpatient services and medications related to the covered conditions. The benefits package comprises inclusion and exclusion lists of services.[viii] In addition, vaccines, antiretroviral (ARV) medicines, sickle cell and cancer screening, contraceptives, tuberculosis commodities, tetanus immunization, anti-snake medicines, malaria vector control program, ambulance service, construction of health training schools, lifts to public hospitals, and health provider system integration, among others, are provided by the Ministry of Health (MOH) but funded by the NHIA under the category of Public Health and Preventive Care and Health Service investment in the NHIA Annual Allocation Formula.

In terms of provider payment, capitation at the primary health care level was piloted in one region (Ashanti), but ultimately suspended due to implementation challenges (Box 1). Ghana Diagnostic Related Groups (G-DRGs)—a form of case-based payments—now covers services at all levels of care.[ix] The tariffs for public health care providers’ services to NHIS members are lower than that for private health care providers because government bears the labor cost and capital investment of the public service. Costs of medicines are reimbursed using fee for service at all levels of care.

2. First wave of DRM reform.

From a DRM perspective, Ghana’s reforms are interesting as they have helped the government move from a system that was largely funded out of pocket to a National Health Insurance Scheme financed by a set of earmarked taxes (National Health Insurance Levy), a social security contribution earmarked from payroll, the Road Accident Fund, premium and investment income, among other sources.

First, the National Health Insurance Act of 2003 (Act 650) expanded the consumption tax to include a 2.5 percent earmark called the National Health Insurance Levy (NHIL), which is collected by the Ghana Revenue Authority (GRA). The government raised the Value Added Tax (VAT) from 12.5 to 15.0 percent in 2004 to contribute to the NHIL, and then to 17.5 percent in 2014 to provide an additional marginal 2.5 percent to the Ghana Infrastructure Investment Fund. Linking an expansion of the consumption tax to health provided an opportunity for the GRA, which would have otherwise faced resistance to increasing the rate.

A share of social security funds was also earmarked for the scheme as a second source of statutory revenue. To secure this earmark, the government had to guarantee that worker pension payouts would not be affected and that they would make up any future shortfalls. As a result, 2.5 percentage points from a 17.5 percent contribution for old employees covered under the 1991 Social Security Law (PNDCL 247) and 2.5 percentage points from an 18.5 percent contribution for any new employees under the National Pension Act, 2008 (Act 766 amended) are both earmarked for the NHIF.[x] The Social Security and National Insurance Trust (SSNIT) manages contributions that come from both pension schemes, although 5 percent of the contributions under the new Act are managed under private pension funds. The SSNIT is then required to transfer 2.5 percentage points from the contributions received into the NHIF.

|

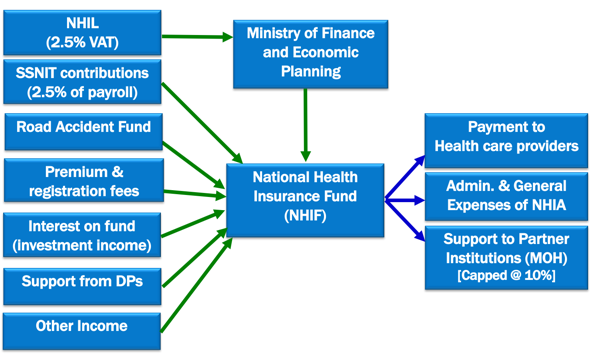

Figure 3. Funding Flows and Areas of Spending for NHIS

Source: Adapted from Cashin et al 2017 and NHIA Strategic Plan (2015-2018). Notes: NHIL = National Health Insurance Levy; SSNIT = Social Security and National Insurance Trust; NHIF = National Health Insurance Fund; MOH = Ministry of Health.

|

Funds from both the GRA and SSNIT are first paid into a National Health Insurance Levy Account at the Bank of Ghana, then based on instructions from the Ministry of Finance and Economic Planning (MOF) to the Controller and Accountant General, funds are released to NHIA (Figure 3). [xi]

The third source of statutory revenue for NHIS in Ghana is the Road Accident Fund, with contributions mobilized by the National Insurance Commission (NIC). A portion of vehicle insurance paid by vehicle owners is ceded to NHIA by NIC to cover road accident victims. Revenue from this source is relatively small and NIC transfers this money directly to the NHIA operational account.

Other sources of revenue include Internally Generated Funds (IGF), such as premiums and registration fees, credentialing fees from health care providers and investment income, which together in 2019 made up 7.5 percent of all revenue for NHIA. Formal sector workers contribute to the NHIS through Social Security payroll contributions, while other beneficiaries, including those in the informal sector, pay flat-rated premiums. The NHIS introduced a flat-rated premium to simplify implementation, in response to challenges of assessing income levels outside the formal sector. Children (under 18 years), pregnant women, those aged 70 years and above, pensioners under SSNIT Scheme, SSNIT contributors, as well as indigents (those classified as poor according to Ghana’s social cash transfer program, Livelihood Empowerment Against Poverty [LEAP]) are exempt from premium payments. However, it is a challenge to identify and target the poor for exemption. When delays occur in the release of funds from the NHIL account by the government, other sources of funds act as a cushion to the NHIA. Funds from international donors that directly support any aspect of NHIA’s operations also go straight to NHIA operational accounts.

NHIA spends its revenue in three main areas: payment to health care providers including private providers, administrative and operational expenses, and support to the Ministry of Health (Figure 3). Of the funds mobilized for running the NHIS, approximately 70 percent go to health care providers, 20 percent to administrative and general expenses, and 10 percent to the Ministry of Health through a capped “release valve” that allows for emerging priorities to be funded.

3. Revenue impacts of first reform.

In 2014, total earmarked revenue was just under GH₵1 billion (US$338.20 million), amounting to 91 percent of total funding (Table 2), with the NHIL and SSNIT making up an average share of 69 and 22 percent of NHIS revenue, respectively. The earmarked funding per beneficiary was GH₵92.96 (US$32.07).[xii] Despite this revenue base and the use of investment reserve funds to finance gaps, NHIS revenues fell short of recurrent expenditures by GH₵16.84 million (US$11.92 million) in 2009; payments to health care providers were delayed, and the NHIS went into arrears.

The liquidity challenges facing the NHIS are explained by the NHIA recording a cash ratio of less than 20 percent on the average (2013-2019). This means that the bank and cash balances together with short-term deposits of the NHIA are unable to meet 20 percent of its short-term obligations at a given time. This is attributable to a decline in investment reserves, delay in the release of funds to the NHIA and increased cost of the scheme. The delay in release of funds distorts the cash plan of NHIA, which causes early redemption of investment to finance the obligations at a cost.

Delay in payment of health care providers negatively affects the operations of the providers by limiting their ability to pay for medical supplies. In order to keep their operations running, some providers unlawfully bill NHIS members causing out of pocket (OOP) payments, which affect access to health care and make the poor more vulnerable and impact both member satisfaction and overall equity of the Scheme. In some cases, there is the possibility of unscrupulous providers re-billing NHIA for services that were paid OOP, which could go undetected due to the largely manual and unintegrated system in place.

The low NHIS population coverage of 41 percent as at the end of 2019 having operated for over fifteen years could be attributed to low service quality of the Scheme. The service quality is influenced by timeliness in release of funds to health care providers, timeliness in review of tariffs for medicines and services covered by NHIS, quality of service delivery to NHIS members at NHIA district offices and health care providers’ sites, strong system in place to detect and prevent levying of unauthorized charges by providers and strong legal system in place to timely sanction health care providers and NHIS members who misconduct themselves.

|

Box 1. Ghana’s Experience with Provider Payment Reform Ghana has had mixed experiences with provider payment reform. NHIS started with the fee-for-service payment method in 2005, but it rewarded providers indiscriminately as they provided services to members even if the services were not needed. The Ghana-Diagnostic Related Grouping (G-DRG) payment method was introduced in 2008, leaving in place the itemized fee-for-service mechanism for medicines. The G-DRG method groups related diagnoses and procedures and determines the average cost per treatment in that group, which forms the basis of the tariffs used by health care providers. Ghana began introducing capitation in 2012 but suspended it in 2017 due to implementation and political challenges as well as complaints from health care providers. |

While the passage of Act 852 helped to rectify some issues with harmonization across district offices and injected efficiency into the NHIS, other challenges persisted, including continued delays in release of earmarked funds to NHIA. For instance, the time lag from revenue collection of NHIL and SSNIT contributions to actual release of funds to NHIA is about five to six months due to delays in government paying social security contributions of public sector workers to SSNIT and different NHIL collection, reconciliation, and transfer mechanisms for domestic and import taxes. Additionally, there have been inadequate expenditure controls, such as through low implementation of strategic purchasing modalities that might improve efficiency (Box 1); increase in tariffs for medicines and services rendered to insured members; and largely manual submissions and vetting of health care providers’ claims as well as high administrative and operational costs.

Reforms such as membership authentication at health care provider sites and increased clinical and compliance audits have been instituted to curb the open-ended provider payment systems that were the main source of unchecked growth; however, concerns regarding the financing of the NHIS continue to persist. To mitigate issues involving late payment of claims to health care providers as a result of delay in release of funds, in 2011 and 2012 the NHIA secured alternative funding at a cost to finance the gap. Additionally, on a number of occasions, NHIA has made proposals to the government to increase funding, for instance, by lobbying for increases in the National Health Insurance Levy, upward review of premiums, introduction of new direct contributions from employers and employees outside of their social security contributions, introduction of a health/sin tax, and communications service tax, to name a few. These proposals, contained in review documents as recommendations, had not been granted as at the close of 2020. In fact, politicization of the NHIS has negatively affected the ability to make any effective requests for additional revenue for health. While the premium has not seen any major adjustment in some time due to lack of political will on the part of government, an increase in premiums remain unpopular, as opposition political parties can exploit the issue to campaign against the incumbent, declaring this would lead to worsened outcomes for the poor majority. As such, no other significant revenue-raising efforts for the NHIS has been made. By 2017, the funding gap was reported as GH₵379.69 million (US$87.20 million).[xiii]

4. Second wave of DRM reform.

To address the NHIS funding gap while circumventing political issues associated with consumption tax rate adjustments, in 2018 the government decoupled the NHIL and the GETFund Levy[xiv] for education from the VAT and made them straight levies with individual constant marginal rates, which allowed the government to increase revenues without changing the rate value. To apply this change, the NHIL (2.5 percent) and GETFund Levy (2.5 percent) remained at their current rates, and VAT remained at 12.5 percent. However, NHIL and GETFund Levy are computed and added first to the value of taxable supplies of goods and services. The 12.5 percent VAT is then charged on the total value, which includes the NHIL and GETFund Levy.

This proposal was initially well-received by those in the health sector, as it was considered to have positive impacts on revenue for health. However, there was a catch. In 2017, a nonsector-specific cap, setting the amount of earmarked revenue that can go to a source, was also put in place under the Earmarked Funds Capping and Realignment Act, 2017 (Act 947). On an annual basis, the cap for each statutory fund is determined by an overall assessment of current government priority programs for that year, with the allocation of domestic resources aligned accordingly. Under Act 947, all allocations to the various statutory funds must not exceed 25 percent of all government revenue. The capping provides an avenue to deal with budget rigidities and create enough fiscal space for government to undertake its economic policies. While this provided a “check” on overspending, it also created a mechanism for the Ministry of Finance and Economic Planning to retain additional revenue that was raised for health, education and others, realigning funding flows to weaker areas and avoiding the need to increase taxes in other ways. The budget statement now includes both how much the government will collect and how much it expects to pay to the NHIF—plausibly leaving unused revenue to be reallocated for other fiscal purposes. As such, the cap is seen as a negative measure by the health sector, weakening the power of the 2018 reform and constraining potential revenue for NHIS operations.

In March 2020, Ghana recorded the first incidence of the coronavirus disease (COVID-19) and the effect of the pandemic caused the Ghanaian economy to contract in the second and third quarters of 2020. The impact of the pandemic caused government total revenue to fall while government total expenditure increased, thereby widening the fiscal deficit for 2020. The Fiscal Responsibility Act, 2018 (Act 982) requires that the budget deficit shall not be more than 5% of Gross Domestic Product (GDP). The projected budget deficit for 2020 was 4.7% of GDP. However, by the end of 2020 this had increased to 11.7% of GDP due to the expenditure on the pandemic, and as such the fiscal rule was suspended under section 18 of the Public Financial Management Act, 2016 (Act 921), which is allowed in times of natural disaster, public health epidemic and war among others. The pandemic affected the annual GDP growth rate as the country recorded 0.4 percent as opposed to the initial projected figure of 6.8 percent for the year 2020.

The COVID-19 pandemic negatively affected government tax revenue for 2020 and consequently the National Health Insurance Levy. The Ghana Revenue Authority was able to mobilize for the National Health Insurance Levy a total amount of GH₵1.80 billion (US$321.37 million) out of the initial budgeted revenue of GH₵2.01 billion (US$358.86 million) leaving an adverse variance of GH₵210 million (US$37.49 million). To mobilize domestic resources, to deal with the COVID-19 pandemic, the government introduced a COVID-19 Health Levy by increasing the NHIL from 2.5 percent to 3.5 percent per the COVID-19 Health Recovery Levy Act, 2021 (Act 1068) in 2021.[xv] This is to provide the requisite resources to sustain government’s effort in dealing with the COVID-19 pandemic from 2021.

5. Revenue impacts of second reform.

The new financial dynamic between the NHIF, the cap, and the straight levy are complicated (see notes to Table 2). The straight levy is estimated to generate an additional GH₵250 million (US$54.46 million) annually for NHIS. While resource transfers have seen gradual increases over time, the NHIF has never been credited with all resources raised within the same year for its purpose, with the amount transferred to NHIF averaging approximately 70 percent of total revenue raised annually. As a result of the cap, NHIA had a revenue shortfall of about GH₵1.5 billion (US$302.89 million) from 2017 to 2020. As of 31st December 2019, most health care providers’ bills had only been paid on average up to April 2019, and eight months of claims (May to December 2019) were outstanding. Given that there is a three-month window to adjudicate claims, this leaves five months of outstanding payments. By the end of 2020, the arrears had reduced from five months to three months due to improvement in release of funds to NHIA, which helped to manage provider complaints in 2020.[xvi] While there are discussions to exempt the NHIL and Social Security contributions levies from the capping system, this situation is still unfolding. NHIA through its constant engagements was able to dialogue successfully with MOF and SSNIT so in April 2020, it was agreed that SSNIT directly transfer SSNIT contributions to NHIA, including arrears starting from December 2018. This had positive effect on the total revenue position of NHIA and increased the liquidity of the Scheme in 2020.

Further, there have been secondary impacts of the revised tax structure. For instance, both the NHIL and GETFund Levy are now treated as “business expenses,” where businesses can no longer claim input tax credits against them, and these are thus at a cost to the firm.[xvii] On the positive side, the reengineering of the indirect tax on goods and services increased visibility of funds to the education sector. On VAT receipts, the GETFund levy has been added as a separate line along with the NHIL, providing additional transparency for consumers.

As a more recent development, and in order to combat the effects of the COVID-19 pandemic and put the Ghanaian economy back on track, the government is seeking to increase domestic resources mobilization and has increased the NHIL by one percentage point. The additional funds to be generated in 2021 through this increase, which is estimated at GH₵889.07 million (US$153.29 million) will be earmarked as a COVID-19 Health Recovery Levy, and will not go directly to NHIA but instead allocated to MOH to procure COVID-19 vaccines and other commodities. In the 2021 Budget Statement and Economic Policy, the Ghana government is expected to raise a total amount of GH₵3.02 billion (US$525.16 million) from the existing 2.5 % NHIL and SSNIT contributions, out of which GH₵1.90 billion (US$330.40 million) will be allocated to the NHIA and the difference of GH₵1.12 billion (US$194.76 million) to be channeled to other priority areas due to the capping system in place.

Table 2. Ministry of Finance, Total Revenue to NHIA, by Source and Amount Generated from Earmarks

6. Broader impacts of both reforms on public spending for health.

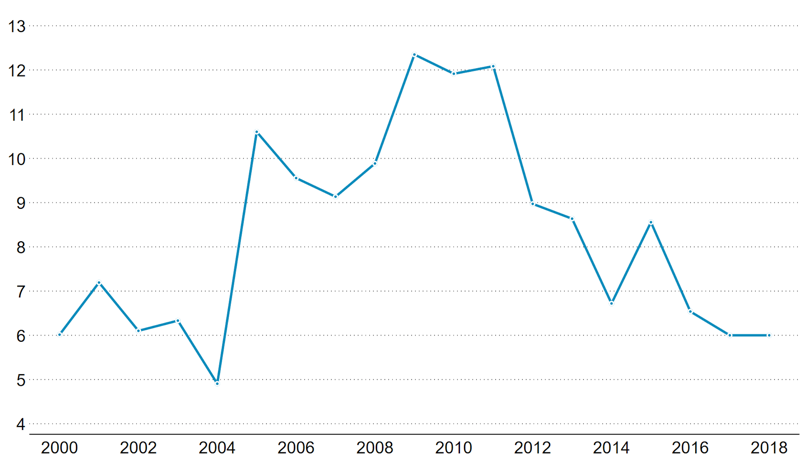

The earmarked funds provide on average 26 percent of funding for public programs in the health sector. During the first wave of reform and establishment of the NHIS, the earmarks had a positive impact on overall public spending for health: from 2004 to 2010, public spending on health rose from 0.75 percent of GDP to 2.38 percent of GDP (see Figure 1). While the NHIF has led to an increase in domestic public spending on health, over time the total allocation to health as a share of government expenditure decreased after an initial period of overall growth (Figure 4) due to competing demands of other sectors, weakening the net impact and additionality of these reforms, and indicating that there has not been long-lasting reprioritization between health and other sectors.[xviii]

Figure 4. Evolution of Ghana’s Domestic general government health expenditure (GGHE) as a Percentage of Government Expenditure, 2000-2018[xix]

Source: WHO Global Health Expenditure Database (2021)

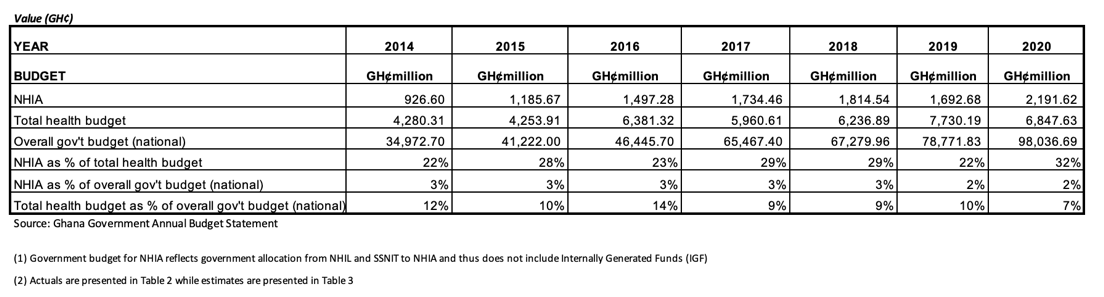

Furthermore, trends starting in 2014 indicate that the straight levy or cap may have an impact on the relative position of the NHIA to the overall government budget (Table 3). For instance, the NHIA budget as a proportion of the overall government budget reduced from 3 percent in 2018 to 2 percent in 2019 and 2020. Similarly, there was a reduction of the total health budget as a proportion of the overall government budget from an average of 12% (2014 to 2016) to 9% (2017 to 2020).

Table 3. Trends in Relative Budget Estimates for NHIA compared to Overall Health and Government Budget

7. Conclusion.

Earmarking was critical in allowing Ghana to establish its lauded National Health Insurance Scheme. However, some operational inefficiencies and inadequate expenditure controls impacted the financial sustainability and caused the scheme to operate at a deficit for some years. While a variety of reforms aimed at improving efficiency have helped to reverse this trend, experience has shown that earmarked resources did not lead to long-term reprioritization of health within the government budget. Subsequent reform that aimed to increase the amount of revenue collected through the National Health Insurance Levy (NHIL) was limited by a general cap on earmarked revenue. As such the additionality of the reform aimed at increasing revenue for NHIA remains in question. Most recently, the introduction of the COVID-19 Health Recovery Levy through an increase in the NHIL represents a major change that will provide a beneficial stream of funding to the health sector to meet emergency needs, although longer term impacts remain to be seen. In the case of the initial earmark as well as in subsequent reform, earmarking for health did provide a way for the government to expand tax collected from VAT to channel toward health as well as other priorities.

1 This note is written by Daniel Asare Adin-Darko ([email protected]) with support from Danielle Bloom and Jewelwayne Salcedo Cain, as well as inputs from Ajay Tandon, Ali Hamandi, Maria Eugenia Bonilla-Chacin, Somil Nagpal and the Joint Learning Network’s Domestic Resource Mobilization (JLN DRM) collaborative.

Daniel Asare Adin-Darko is a Deputy Director in the Finance and Investment Division of NHIA. He is a chartered accountant, chartered tax practitioner, and a chartered economist.

Daniel Asare Adin-Darko is a Deputy Director in the Finance and Investment Division of NHIA. He is a chartered accountant, chartered tax practitioner, and a chartered economist.

With gratitude, we acknowledge the guidance and technical review from colleagues in the National Health Insurance Authority of Ghana, Ministry of Health, Ghana, and in the World Bank: Vivian Addo-Cobbiah,1 Francis Owusu,1 Yaa Pokuaa Baiden,1 Gustav Cruickshank,1 Francis Asenso-Boadi,1 Francis-Xavier Andoh-Adjei,1 Nicholas Afram Osei,1 Rudolf Zimmerman,1Magnus Owusu-Agyemang,1 Eric Nsiah-Boateng,1 Emmanuel Kwakye Kontor,2 and Anthony Theophilus Seddoh.3

1 National Health Insurance Authority of Ghana.

2 Ministry of Health, Ghana.

3 The World Bank Group.

The World Bank’s support to the Joint Learning Network for UHC is made possible with financial contributions from the following partners:

[1] This note updates information provided in the 2017 WHO working paper: C. Cashin, S. Sparkes, and D. Bloom. 2017. “Earmarking for Health: From Theory to Practice.” Geneva: World Health Organization. License: CC BY-NC-SA 3.0 IGO.

[i] Reversal of the upward trend in domestic public health expenditure observed circa 2011 (Figure 1) may be attributable to documented reductions in growth of both the health share of general government expenditure and the general government expenditure as a share of GDP.

[ii] Except during 2015–2020.

[iii] GH₵ = Ghanaian cedi.

[iv] Section 27 (1) of the NHIA 2012, Act 852, says, “A resident of Ghana shall belong to the National Health Insurance Scheme.”

[v] I.A. Agyepong, D.N.Y. Abankwah, A. Abroso, C.B. Chun, J.N.O. Dodoo, S. Lee, S.A. Mensah et al. 2016. “The Universal in UHC and Ghana’s National Health Insurance Scheme: Policy and Implementation Challenges and Dilemmas of a Lower-Middle-Income Country.” BMC Health Services Research 16: 504.

[vi] A. Kwarteng, J. Akazili, P. Welaga, P.A. Dalinjong, K.P. Asante, D. Srpong, S. Arthur et al. 2020. “The State of Enrollment on the National Health Insurance Scheme in Rural Ghana after Eight Years of Implementation.” International Journal for Equity in Health 19: 4.

[vii] NHIA Statistical Bulletin 2018 puts the coverage at 37 percent for 2017.

[viii] Type of care covered under NHIS benefits package includes outpatient and inpatient services, oral health and eye care services, maternity care and emergencies. It excludes services like rehabilitation (other than physiotherapy), cosmetic surgeries and aesthetic treatment, HIV retroviral drugs, dialysis, orthoptics, organ transplanting, and mortuary services among others.

[ix] Case-based payments can be developed based on a schedule of payments linked to diagnosis, often called diagnostic-related groups. These can be linked to standard disease classification systems such as International Classification of Diseases (ICD)-10

[x] All employees born before December 31, 1959, fall under the old pension scheme and contribute 5.0 percent of their basic salaries, while employers contribute 12.5 percent bringing the total to 17.5 percent.

[xi] Adapted from Cashin C., Sparkes S., Bloom D. Earmarking for health: from theory to practice. Geneva: World Health Organization; 2017. License: CC BY-NC-SA 3.0 IGO.

[xii] Note that this estimate was the revenue per beneficiary in 2014 and not per capita expenditure. Active membership in 2014 equaled 10.545 million.

[xiii] According to the NHIA’s 2017 Allocation Formula (budget).

[xiv] The Ghana Education Trust Fund (GETFund) levy was established in 2000 and is also funded through VAT.

[xv] Taking effect from 1st May, 2021, Act 1068 is a straight levy and is not allowable as an input tax deduction. This has the effect of increasing business expenses and prices of goods and services.

[xvi] The direct transfer of funds from SSNIT to NHIA in 2020, improvement in release of funds by the Government to enable health care providers to manage the COVID-19 pandemic and the priority of the Government in 2020 contributed to this performance.

[xvii] World Bank. 2019. Doing Business 2020: Comparing Business Regulation in 190 Economies. Washington, DC: World Bank Group.

[xviii] Cashin C., Sparkes S., Bloom D. Earmarking for health: from theory to practice. Geneva: World Health Organization; 2017. License: CC BY-NC-SA 3.0 IGO.

[xix] Presented on February 1, 2020, by N. Otoo at Prince Mahidol Award Conference, “Parallel Session 2.1 Fiscal Space for Health: A Country Perspective from Ghana.” Data from 2019.

Have any reflections from your JLN experiences? Please share them using the comments feature, below.

You have done a great work. Thank you for enlighten me.

Great article. Very well structured and well researched. I have to be reading over and over.

A very detailed and informative article on the NHIS. As a nation, we must have the political will to ensure the sustainability of the scheme by looking at some of the points raised. Kudos, my brother.

A very insightful article with facts and figures. Well done Mr Adin-Darko. I have actually learned a lot about the scheme through this write up.

I have, however, observed that challenges highlights on funding partners or agents of funds mobilization and the political players. Their inability to review standing policies essentially the premium.

The difficulties faced the scheme managers was somewhat subtle. There seem to be a gap between the the NHIS and the service providers with regard to the control and checks on fraud perpetuated by service providers. They defraud both the vulnerable beneficiaries and the scheme by making clients pay for services being covered by the scheme and putting claims to the nhis office at the same time.

I humbly suggest the scheme establishes a customer service desk independently at least on all major Government health facilities. That desk should desplay all services available to subscribers in print boldly at entrances, the labs and most importantly at the pharmacy. These should boldly indicate what medicines are fully covered and those partially covered that beneficiaries need to top up as I personally experienced paying for what might have been covered from lab to the pharmacy at a District Hospital in the Greater Accra Region. This will bring some openness and fairness to both stakeholders.

Alas the system must start to work from a point

Thank you for sharing your personal experience at the hospital. Indeed the out of pocket payments need urgent attention in order to restore confidence in the Scheme.

A well researched article, it can be predicted that in future increasing funding for the NHIF will mean increase in taxes if the capping system is still in place.

This is a comprehensive report on the activities of the National Health Insurance Scheme right from its inception and how it has performed over the years.

The author has done a very work. Very informative. All stakeholders should have access to this report.

You have done an excellent work. It is well structured. I find this article as one with a difference.

Great work done

This very comprehensive information. Well done this write up.

Excellent Article bringing out the strengths and weakness (performance) of the NHIA and the way forward.

Congratulations

Well written, excellent piece of researched work. Informative, insightful, reflective and very readable. A good addition to the growing literature on the NHIS

Kudos Dan

A very informative blog on the evolution of domestic resource mobilization for health in Ghana.Some of the key lessons that have been highlighted are that for domestic resource mobilization for health to be effective, it must be underpinned by deliberate efforts to improve fund flows and the implementation of efficiency gain, equity inducing and quality improving measures such as strategic purchasing. These considerations are all predicated on strong political will.

Congratulations on the publication of this timely blog Daniel!

I agree! Strategic purchasing of health services is the way to go, which must be backed by strong political will. Thank you.

Very educative, insightful and factual. More grease to your elbows.

Hardly do we often get to read this kind of well-researched information on our health systems. Great work! Waiting to be enlightened more.

A very brilliant informative piece. This is useful for the continuous growth of the NHIS in Ghana and beyond.

The writer has succinctly highlighted the financial issues and the current solutions being implemented.

It’s a very good information on the NHIA and encourage him to do further publication on the financial of the private mutual health insurance schemes as well.

Thank you.

This paper has brought alot of interesting revelation about the sustainability of the health insurance with regards to financing. The pictorial diagrams are very useful too. This work will benefit the academial, the technocrats as well as public officials. Cheers Dan!!! Congrats

Very educative. Congratulations

A simplified version of economic terms to make the reader appreciate the economics informing health care financing in the country Ghana from an insider and its implications, how to improve upon the revenue generation and to keep the scheme sustainable. It has helped shape my understanding.

This paper is on all fours. I look forward to more publications in other areas that will also ensure the sustainability of the health insurance system.

This is a very insightful paper.I wish all those in corporate leadership could read this and have the gist at the center of their strategic decisions. Financial sustainability is a serious and common issue within SOEs that needs to be seriously addressed.

Earmarking of funds by the Government and within the Institutions and adherence to same by the key stakeholders is key in the financial sustainability of the SOEs.

This paper is therefore, clearly on point in addressing this matter. Kudos.

Personally, I am so excited for this publication. For the fact that emperical research in the area of “Financial Sustainability of the NHIS” in Ghana is scanty to the best of my knowledge.

The writer has done a great job by bringing to bear some of the pertinent issues surrounding the NHIS, and the way forward.

Policy makers should pay attention to the content of this paper for implementation of a much better improved service.

In so doing, the SDG goal 3: Good Health Care and Wellbeing would be materialised.

Whilst I congratulate the writer for a good job done, I equally encourage him to do further publications in the coming years.

Once again, well done Sir!

Thank you.

This is an excellent work. My boss kudos. Wao!

This is a well researched paper and insightful and opens a discussion for decision makers and further research. Keep the good work

It is very exciting to see this level of activity and interaction around the Practitioner Perspective Series and congrats to Daniel for an excellent contribution that is receiving so much positive feedback and interaction. It makes the entire DRM collaborative team very happy and motivated, and we hope other members of the DRM collaborative will consider contributions to this series soon.

Agree! Kudos to Daniel for doing such an amazing job pulling together this post and all of the inputs!

Others, please be in touch with the team at [email protected] if you are interested in sharing a write up on your own country experience.

This article has highlighted the true picture of healthcare financing in Ghana. This is timely for the health insurance industry. Excellent work! I look forward for more publications.

A very elaborate approach to this article. Well done Daniel.

A major problem to the financial sustainability of the NHIS stems from lack of commitment from the government to place the needed premium on health. It is sad to note that the 2020 health budget is only 7% of the national budget and that tells us how the government priortizes the health of its citizens.

In an era when we are looking at Universal Health Coverage, 7% of national budget allocation to health is very abysmal and ought to be looked at again, especially, in times of the Covid 19 pandemic.

For lack of discipline even if reforms are developed to increase revenue to fund the NHIS, government would introduce an Act – Earmarked Funds Capping and Realignment Act, 2017 to deny the health sector and for that matter the NHIS, the much needed funding.

Indeed, the repercussions of this is seen in the poor quality of care offered to the citizenry under the NHIS. In as much as I believe in this social insurance for health for Ghanaians, and that healthcare providers must buy in and support it, we should not lose sight of the fact that quality care is paramount and yet not cheap.

Someone ought to pay for the services provided and it is high time the government got truly committed and prioritised healthcare financing in this country.

Thank you, Dan for this research paper.

I agree! Allocating adequate resources to the NHIS and ensuring prompt release of funds to health care providers with adequate monitoring system in place would help to improve the quality of service delivery. Thank you.

This is an insightful research which had thrown light on the issues of financing and sustainability of the health insurance in Ghana. This could be a useful resource to other countries who are also trying to implement this system.

Very informative! Well done Daniel

This is very disheartening to see some of the public and private sector hospitals collapsing the nhis in their dealings. It’s about time this message is known to all in other to help sustain the NHIS to the betterment of the nation, especially, my natives in the rural. God bless u for enlightening me more. Kudos Brother.

Sure! There is the need to address the out of pocket payments and alleged fraud to instill confidence in the Scheme. Thank you.

Looking at the rate at which the cedi is depreciating against the United States dollar, it is clear that the value of the premium at the inception of the policy will have to be reviewed upwards in order to meet the revenue requirements of the scheme. Are there any plans for the premium to be reviewed in the short term?

Good question!

A premium of GH₵7.20 (USD8.05) was charged in the poor communities and GH₵10 (USD11.18) in other places at the inception of the Scheme in 2004. This premium was subsequently increased to GH₵18 (USD17.13) on the average in 2008 and has remained unchanged. The value of the GH₵18 premium in dollar terms as at 31st March 2022 is USD2.53 due to the continuous depreciation of the Cedi.

An upward review of the premium in the short term is necessary to increase revenue for the Scheme.

A very elaborate blog on the NHIA and its sustainability coupled with the socio-political systems affecting smooth management to achieve Universal Health Coverage in Ghana. It is also appropriate for government to completely separate other operations of state funding from the NHIL to be directly remitted to a reserved account for reimbursement to Healthcare Providers timely.

Great work and a paper for the National Health Insurance Authority to adopt as one of the reference books.

You research work from inception to date on NHIA can not be overemphasized.

Kudos! My brother

This is a comorehensive piece which touches on the pertinent issues of sustainable health insurance financing with specific experience from Ghana. The author has done a great job by chronicling the sequence of health insurance financing policies as well as the structure of the NHIA.

It’s fascinating to know the proportion of health expenditure to total government expenditure reduced from 12% (2014-2016) to 9% (2017-2020). Though I do not have the data this could be due to the government’s policy on free SHS hence such reduction in health spending would have gone into funding education.

It will be good to ascertain the impact of this shift on the wider economy.

Well done Daniel!!!

Yes! Further studies can determine the reason for the fall, how it was allocated and the impact. Thank you.

An excellent and true piece of researched work that reflects the past and present circumstances of the NHIS in Ghana.

Perhaps the time has come to interpret sustainability in a much broader context to include and reflect increasing allocation and inflow of funds to accommodate percentage growth in enrollment, active membership, physical access and improving quality of healthcare delivery. In effect Sustainability and Growth must presuppose each other.

A stronger political will and commitment is required to develop a road map and time frame towards the achievement of the ultimate objective of UHC

Congratulations Dan

Thank you and to add to this, Scheme would experience rapid growth in membership in the coming years with the formalization of the economy. The linkage of the NHIS card to the Ghana Card currently ongoing, and the Ghana Card eventually replacing the NHIS card, members can easily renew their cards at their convenience. Your suggestions are therefore very important for policy consideration.

Also, in our progress towards UHC, high growth in membership level of the Scheme is only a NECESSARY CONDITION. The SUFFICIENT CONDITION will be adequate measures put in place to prevent out of pocket payment at the point of accessing health care. This has serious implications for membership renewal and new enrollments onto the Scheme, which are influenced by member satisfaction and perceived satisfaction respectively.

Good work, Dan. Your publication is very educative and informative. It highlights the key issues to ensuring the continuous sustainability of our social healthcare system in Ghana.

A well-chronicled information on the NHIS giving a good insight on the efforts of the NHIA and Government to ensure sustenance of the scheme from inception. Great coverage on the revenue side. Well done Daniel. As the conversation continuous on UHC more articles are needed on the broad categorization of the expenditure side especially on payments to providers against tertiary health, secondary health and primary health to foster more reforms for sustainability. Excellent work.

I agree! The expenditure side will help to show the allocative efficiency of the resource utilization. Thank you.

Well done my brother Dan. This publication is as a results of more experience gained in the sector. It takes selfless and more discipline to present this well structured and educative publication. I believe that the authorities will dive more into this to solve part of our health issues in the country in terms of it sustainability of our social healthcare system in Ghana. Good job.

An excellent and true reflection of the past and present of NHIS in Ghana. I have no doubt on your capabilities for such educative publication.

Your publication gives much details on the inflows and outflows of the scheme and for that matter the possible financing gap which is a threat to Financial Sustainability of the scheme.

Whilst I congratulate you for a good job done, I equally encourage you to do further publications in the coming years on the genuineness of Claims (bills) from service providers which is a serious threat to Financial Sustainability of the scheme.

well done my Director.

I agree! Claims cost is the major cost driver so all efforts is required to check its authenticity in order to control cost. Thank you.

Actually, this study on the financial sustainability of the NHIS in Ghana is very thought provoking. A lot of salient points and areas have been raised and I would like to commend the author for the effort.

I believe the study would go a long way to influence decisions of policy makers on how to ensure financial self- sufficiency of the scheme.

I wish to respectfully submit that the study should form the basis for further studies into monitoring indigents registration processes and excesses in claims generation, processing and payment in order to plug the loopholes that could drain the finances of the Scheme and threaten its financial self- sufficiency.

Once again, I thank you tor this piece and I hope it will assist in finding solutions to the challenge of ensuring financial sustainability of the Scheme to be able to operate into the foreseeable future.

Sure! There should be continuous strengthening of the controls in the registration of people classified as indigents so the premium paying members don’t sneak in.

Also, the deployment of integrated ERP Claims Management System with adequate controls would help to check the generation of claims from health care providers so it can be free from any material errors and fraud. Thank you.

This is very detailed and very informative. Mr. Adin Darko has done a thorough and great work. Kudos

Insightful and provocative. Good job. Can we review “the-same-rate-for-all” for members from the informal sector too to bring in more proceeds to help address the funding gap? The current state where everybody from the informal sector pays the same when earnings aren’t the same does not ensure equity. I can recollect some experiences we had when I joined in 2004. Payment by a member to enroll under the scheme was always influenced by some socio-economic circumstances of the member. Although it had its own weaknesses we can still learn from some positives it presented. Possibly the modalities in past may need to be polished now.

I agree! The flat-rated premium for those in the informal sector does not ensure equity. Premium payment should be based on ability to pay so that the rich can cross-subsidize the poor. The difficulty in the past has been the lack of data to properly assess the income levels of the large numbers in the informal sector. With the gradual formalization of the Ghanaian economy, where Ghana Card is issued to each individual and the unique identification number on the Card also becoming the Tax Identification Number, I believe policy makers can leverage on that going forward to set new premium levels.

It is a well researched article on earmarked funding with detailed analyses from a practitioners perspective. It gives a very detailed account of funding for health insurance in Ghana from beginning to its current form. One thing that remains clear is that the sustainability of the scheme is still a challenge and this will take a bold political will to put the scheme on a sound footing. The capping of funds generated for the Scheme has not help matters and I side with the writer for keystakeholders to consider exempting the fund from being capped. This will free more resources to help build a healthy nation and inure to the benefits of Ghana. The article is a master piece that has shaped my thoughts on health financing in Ghana. No doubt, it has contributed to literature and will serve as rich research material for everyone. Great job Dan.

This is a great point! The exemption from capping could help to unlock an important policy bottleneck.

The major threat to the sustainability of the NHIS programme in Ghana is the capping of all statutory funds not to exceed 25% of tax revenue. By the capping, technically, there is no earmarked funds for the NHIS. The NHIS is currently funded by the use of “warrants” from the Ministry of Finance. Thus, the Minister of Finance is using his discretionary powers to allocate resources for the Scheme. All those who believe in the concept of the NHIS as it was designed need to add their voices to ensure that the Minister of Finance sends amendment to that Act which capped the NHIF as part of the capping of statutory funds.

This coupled with elimination of corruption in the management of the funds will gona long way to sustain the scheme.

Thanks for this insightful contribution. You raise an important question about whether the cap only weakens, or rather negates completely the benefit of an earmark. Exempting NHIS from the cap may be one necessary condition, while a sufficient condition will be to ensure that there is an environment established that also ensures efficiency in resource use and value for money.

Excellent write up! It is surely going to generate interest and discussions on the financing of NHIS in Ghana to make it more sustainable, especially at a time where some group of people are advocating for expansion of NHIS benefits package to include more ailments.

The article is very insightful and I believe it will be a very good resource material for further research into healthcare financing in Ghana. Well done, Mr. Adin-Darko.

Sure! Expansion of the benefit package will mean the Scheme will require more resources to meet this expenditure. Thank you.

Excellent piece explaining the various funding sources and what actually gets remitted to the NHIS.

Why is it an offense not to pay the health insurance tax/levy but okay to delay and cap remittance to the beneficiary institution in the name of law!

Will the NHIS/NHIA become richer than Ghana?

Future reforms must include direct remittance from all sources to the Scheme and removal of all caps, with the required controls sitting with the NHIA.

Important points- it is interesting to see such wide support for removal of the caps!

Thank you all for the feedback. My appreciation goes to the NHIA and the World Bank technical team for the support, inputs and excellent review to help come out with this publication.

The paper has fully captured the NHIA/NHIA’s journey noting the various stop-overs, changes and its current state of affairs in terms of funding. It is clear from the data that even without any additional taxes, the NHIA is financially sustainable if current the revenue from the various sources are allowed to flow without diversions, capping ‘biting’ and delays in releases. The NHIA has been used and is still being used by various governments to tax and collect revenue in the name of the NHIL but those funds never get to their target destiny (NHIF).

Works such as this paper are necessary in contributing to efforts in pulling funding to the NHIA and the health sector as a whole by CSOs, Development partners, opinion holders etc.

Congratulations using your vast expertise, knowledge and training to contribution this much to the ongoing discourse in looking for adequate funding for the NHIA.

Sure! The Scheme could be on a good footing with the full flow of funds to NHIA and adequate expenditure controls. Thank you.

This is a very comprehensive report touching on the efforts being made from inception to ensure financial sustainability of the Scheme.

This report could influence timely release of funds, and identify other sources of funding.

Congratulations, Daniel

The issue of ‘Provider shopping’ by members should be looked at carefully because the sustainability of the scheme is key. There should be broader consultations on how to manage members in terms of multiple attendance which also increase cost unnecessarily. Technology may assist in our quest to monitor members abuse but other modes of payments may be explored; however it may require a strong will power on the part of all key stakeholders.

I agree! The deployment of robust and integrated Enterprise Resource Planning (ERP) system of Claims Management across the health care provider sites with adequate controls would help to check provider shopping and impersonation by members to reduce claims cost. Thank you.

A really informative piece. Indeed, the manual and unintegrated systems of healthcare provision and claims adjudication is a really big source of leakage to the NHIA. All required efforts and investments must be put in this area to block that major loophole.

Yes! A robust and integrated ERP claims management system would help to address this. Thank you.

𝑽𝒆𝒓𝒚 𝒊𝒏𝒔𝒊𝒈𝒉𝒕𝒇𝒖𝒍 𝒑𝒊𝒆𝒄𝒆 𝒔𝒉𝒐𝒘𝒊𝒏𝒈 𝒉𝒐𝒘 𝑮𝒉𝒂𝒏𝒂’𝒔 𝑯𝒆𝒂𝒍𝒕𝒉 𝑰𝒏𝒔𝒖𝒓𝒂𝒏𝒄𝒆 𝑺𝒄𝒉𝒆𝒎𝒆 𝒉𝒂𝒔 𝒆𝒗𝒐𝒍𝒗𝒆𝒅 𝒐𝒗𝒆𝒓 𝒕𝒊𝒎𝒆. 𝑾𝒉𝒂𝒕 𝒍𝒊𝒕 𝒖𝒑 𝒇𝒐𝒓 𝒎𝒆 𝒘𝒂𝒔 𝒘𝒉𝒆𝒏 𝒚𝒐𝒖 𝒉𝒊𝒈𝒉𝒍𝒊𝒈𝒉𝒕𝒆𝒅 𝒕𝒉𝒆 𝒆𝒇𝒇𝒆𝒄𝒕 𝒐𝒇 𝒅𝒆𝒍𝒂𝒚 𝒊𝒏 𝒑𝒂𝒚𝒊𝒏𝒈 𝒉𝒆𝒂𝒍𝒕𝒉 𝒄𝒂𝒓𝒆 𝒑𝒓𝒐𝒗𝒊𝒅𝒆𝒓𝒔 𝒂𝒏𝒅 𝒉𝒐𝒘 𝒕𝒉𝒆𝒚 𝒂𝒍𝒔𝒐 𝒖𝒏𝒍𝒂𝒘𝒇𝒖𝒍𝒍𝒚 𝒆𝒙𝒑𝒍𝒐𝒊𝒕 𝑵𝑯𝑰𝑺 𝒎𝒆𝒎𝒃𝒆𝒓𝒔 𝒃𝒚 𝒄𝒂𝒖𝒔𝒊𝒏𝒈 𝒐𝒖𝒕 𝒐𝒇 𝒑𝒐𝒄𝒌𝒆𝒕 𝒑𝒂𝒚𝒎𝒆𝒏𝒕 𝒂𝒏𝒅 𝒍𝒂𝒕𝒆𝒓 𝒓𝒆-𝒃𝒊𝒍𝒍𝒊𝒏𝒈 𝑵𝑯𝑰𝑨 𝒇𝒐𝒓 𝒔𝒆𝒓𝒗𝒊𝒄𝒆 𝒓𝒆𝒏𝒅𝒆𝒓𝒆𝒅 𝒇𝒐𝒓 𝒘𝒉𝒊𝒄𝒉 𝒕𝒉𝒆 𝒎𝒆𝒎𝒃𝒆𝒓 𝒉𝒂𝒔 𝒂𝒍𝒓𝒆𝒂𝒅𝒚 𝒑𝒂𝒊𝒅.

𝑾𝒆 𝒄𝒂𝒏 𝒄𝒖𝒓𝒃 𝒕𝒉𝒊𝒔 𝒎𝒆𝒏𝒂𝒄𝒆 𝒃𝒚 𝒊𝒏𝒗𝒆𝒔𝒕𝒊𝒏𝒈 𝒊𝒏 𝒂 𝒓𝒐𝒃𝒖𝒔𝒕 𝑰𝑪𝑻 𝒑𝒍𝒂𝒕𝒇𝒐𝒓𝒎 𝒘𝒉𝒆𝒓𝒆 𝑵𝑯𝑰𝑺 𝒎𝒆𝒎𝒃𝒆𝒓𝒔 𝒐𝒓 𝒕𝒉𝒆 𝒔𝒖𝒃𝒔𝒄𝒓𝒊𝒃𝒆𝒓 𝒘𝒊𝒍𝒍 𝒃𝒆 𝒎𝒂𝒅𝒆 𝒕𝒐 𝒔𝒊𝒈𝒏 𝒐𝒓 𝒄𝒐𝒏𝒔𝒆𝒏𝒕 𝒕𝒐 𝒕𝒉𝒆 𝒄𝒍𝒂𝒊𝒎𝒔 𝒔𝒖𝒃𝒎𝒊𝒕𝒕𝒆𝒅 𝒐𝒏 𝒕𝒉𝒆𝒊𝒓 𝒃𝒆𝒉𝒂𝒍𝒇 𝒕𝒐 𝒃𝒆 𝒓𝒆𝒊𝒎𝒃𝒖𝒓𝒔𝒆𝒅 𝒃𝒚 𝑵𝑯𝑰𝑨. 𝑻𝒉𝒊𝒔 𝒎𝒆𝒂𝒏𝒔 𝒕𝒉𝒂𝒕 𝒃𝒆𝒇𝒐𝒓𝒆 𝒕𝒉𝒆 𝒎𝒆𝒎𝒃𝒆𝒓 𝒍𝒆𝒂𝒗𝒆𝒔 𝒕𝒉𝒆 𝒉𝒐𝒔𝒑𝒊𝒕𝒂𝒍, 𝒉𝒆 𝒐𝒓 𝒔𝒉𝒆 𝒌𝒏𝒐𝒘𝒔 𝒉𝒐𝒘 𝒎𝒖𝒄𝒉 𝑮𝒐𝒗𝒆𝒓𝒏𝒎𝒆𝒏𝒕 𝒘𝒊𝒍𝒍 𝒑𝒂𝒚 𝒐𝒏 𝒉𝒊𝒔 𝒃𝒆𝒉𝒂𝒍𝒇 𝒂𝒏𝒅 𝒘𝒉𝒆𝒏 𝒕𝒉𝒆 𝑯𝒐𝒔𝒑𝒊𝒕𝒂𝒍 𝒇𝒊𝒏𝒂𝒍𝒍𝒚 𝒔𝒖𝒃𝒎𝒊𝒕𝒔 𝒕𝒉𝒆 𝒄𝒍𝒂𝒊𝒎𝒔 𝒆𝒍𝒆𝒄𝒕𝒓𝒐𝒏𝒊𝒄𝒂𝒍𝒍𝒚, 𝒕𝒉𝒆 𝒎𝒆𝒎𝒃𝒆𝒓 𝒔𝒉𝒐𝒖𝒍𝒅 𝒃𝒆 𝒏𝒐𝒕𝒊𝒇𝒊𝒆𝒅 𝒂𝒈𝒂𝒊𝒏 𝒗𝒊𝒂 𝒕𝒉𝒆 𝑰𝑪𝑻 𝑷𝒍𝒂𝒕𝒇𝒐𝒓𝒎 𝒇𝒐𝒓 𝒄𝒐𝒏𝒇𝒊𝒓𝒎𝒂𝒕𝒊𝒐𝒏. 𝑻𝒉𝒊𝒔 𝒊𝒔 𝒕𝒉𝒆 𝒐𝒏𝒍𝒚 𝒘𝒂𝒚 𝒘𝒆 𝒄𝒂𝒏 𝒔𝒕𝒐𝒑 𝑯𝒆𝒂𝒍𝒕𝒉 𝒄𝒂𝒓𝒆 𝒑𝒓𝒐𝒗𝒊𝒅𝒆𝒓𝒔 𝒇𝒓𝒐𝒎 𝒎𝒊𝒍𝒌𝒊𝒏𝒈 𝒕𝒉𝒆 𝒔𝒚𝒔𝒕𝒆𝒎 𝒂𝒕 𝒕𝒉𝒆 𝒅𝒆𝒕𝒓𝒊𝒎𝒆𝒏𝒕 𝒐𝒇 𝒕𝒉𝒆 𝒔𝒄𝒉𝒆𝒎𝒆.

𝑰𝒇 𝑮𝒐𝒗𝒆𝒓𝒏𝒎𝒆𝒏𝒕 𝒄𝒐𝒖𝒍𝒅 𝒕𝒂𝒌𝒆 𝒔𝒕𝒆𝒑𝒔 𝒕𝒐 𝒔𝒆𝒑𝒂𝒓𝒂𝒕𝒆 𝑵𝑯𝑰 𝒇𝒖𝒏𝒅 𝒇𝒓𝒐𝒎 𝒕𝒉𝒆 𝑪𝒐𝒏𝒔𝒐𝒍𝒊𝒅𝒂𝒕𝒆𝒅 𝑭𝒖𝒏𝒅 𝑨𝒄𝒄𝒐𝒖𝒏𝒕, 𝒊𝒕 𝒄𝒐𝒖𝒍𝒅 𝒈𝒐 𝒂 𝒍𝒐𝒏𝒈 𝒘𝒂𝒚 𝒕𝒐 𝒄𝒖𝒓𝒃 𝒅𝒆𝒍𝒂𝒚 𝒊𝒏 𝒑𝒂𝒚𝒎𝒆𝒏𝒕 𝒐𝒇 𝒐𝒖𝒓 𝒄𝒍𝒂𝒊𝒎𝒔. 𝑨𝒍𝒍 𝒕𝒉𝒆𝒔𝒆 𝒄𝒂𝒏 𝒎𝒂𝒕𝒆𝒓𝒊𝒂𝒍𝒊𝒛𝒆 𝒐𝒏𝒍𝒚 𝒊𝒇 𝒕𝒉𝒆𝒓𝒆 𝒊𝒔 𝒂 𝒔𝒕𝒓𝒐𝒏𝒈 𝒑𝒐𝒍𝒊𝒕𝒊𝒄𝒂𝒍 𝒘𝒊𝒍𝒍

𝑪𝒐𝒏𝒈𝒓𝒂𝒕𝒖𝒍𝒂𝒕𝒊𝒐𝒏𝒔! 𝑫𝒂𝒏𝒊𝒆𝒍 𝑨𝒅𝒊𝒏-𝒅𝒂𝒓𝒌𝒐 𝒇𝒐𝒓 𝒕𝒉𝒊𝒔 𝒈𝒓𝒆𝒂𝒕 𝒘𝒐𝒓𝒌.

Great points for policy consideration.

The out of pocket payments erode confidence in the Scheme. Apart from the delay in release of funds to health care providers, out of pocket payment is also caused by non-competitive payment rate to providers, inadequate knowledge of the benefits package by members, low empowerment of members about their rights and responsibilities, inadequate monitoring of health care providers’ activities and ineffective sanction regime among others, which require urgent redress.

Good work done bro. This insightful research has brought to light our beginnings as well as our current state. it is no doubt that the challenges this study has enumerated on the sustainability of the NHIS is KEY to the attainment of Universal Health Coverage. Thanks for this well researched piece

In reference to Figure 3, the direct transfer of funds from SSNIT to NHIA stopped in July 2021. This is to ensure that the SSNIT contributions go through the Ministry of Finance as before and capped appropriately.

Does the introduction of capping system apply to the SSNIT contributions retrospectively?

To clarify the above question, if SSNIT owed contributions prior to July 2021 will the capping affect such contributions?

Good question-The capping law is already in force so the Controller & Accountant General Department (CAGD) has applied the capping to the SSNIT contributions retrospectively.

This means that the total revenue shortfall to the Scheme from 2017 to 2020 has increased from the initial GH₵1.5 billion (US$302.89 million) to GH₵2.96 billion (US$599.57 million). It implies that transfer of funds to the Scheme in 2021 will be adversely affected.

The sustainability of the Scheme is therefore seriously threatened by this and so the removal of the capping is very necessary.

Great work done on this article!

What is the percentage of funds taken from the scheme as a result of the capping?

Good question-Of the total amount mobilized from the NHIL & SSNIT contributions from 2017 to 2020 amounting to GH₵8.97 billion (US$1.82 billion), the total amount taken for other priorities represents 33%.

In the year 2021, 37% of the earmarked funds for health was allocated for other purposes, which is more than one-third and so very significant.

The Scheme could face liquidity challenges from the third quarter of 2021 if the capping remains in full force.

Will the capping apply to the SSNIT contributions retrospectively?

Responded above

Great piece of work. Very detailed and informative.

Revenue generation should be more pregressive, tax on investments should be considered.

Benefit package should be looked at again to create some space for PHIS to complement the NHIS.

Capping of revenue to NHIF should also cease to allow the levies collected come to the fund to bridge the gap.

I hope this article is read by the power brokers.

Congratulations Mr. Adin-Darko

A well-researched, educative and thought provoking paper.

On the revenue end, it is refreshing to know that attempts are being made to circumvent the bureaucracy to allow at least SSNIT to transfer the 2.5% directly to the NHIA, same should happen to the NHIL as well. It is interesting to learn also that the NHIS lost or was deprived of about GHS 1.5billion between 2017 and 2020, that is an average of GHS 500million a year as a result of the ‘Capping System’. This amount could have done so much in claims payment.

As far as the expenditure bit is concerned, are we able to estimate the cost/value of waste and claims fraud if any?, and how these will affect sustainability. What about illegal out-of-pocket payment? How is that affecting the integrity of the Scheme, uptake of healthcare services and ultimately the attainment of UHC?.

I gather from the piece that earmark funding obviously is the mainstay of the NHIS, which needs enhancement, restructuring etc modification to meet growing demand. Equally, there seem to be an innovative effort at improving membership and operational efficiency which is good and must be sustained.

Earmark funding and for that matter funding (Revenue) generally is one of the key pillars/legs of sustainability of the NHIS. We hope to read on the other legs in your subsequent series.

Kudos

Yes, the direct transfers from SSNIT to NHIA from 2020 improved the liquidity of the Scheme and payments to health care providers and suppliers were much regular, which helped to reduce arrears and provider/supplier complaints. Unfortunately, these direct transfers ceased in July 2021.

Further studies may answer the questions raised. Thank you.

Very good article. Could you please also give the historical development of the payment systems:

1. Itemised bill

2. GDRG

3. then capitation

And provide reasons why they kept changing

Good questions-Box 1 throws light on Ghana’s experience with provider payment reforms.

This is a detailed and well-researched article worth reading. Excellent work. Congrats Daniel

A very succinct chronicle of the financial trajectory of Ghana’s social health insurance scheme. I hope the relational analysis of the legislative strictures and rigidities in the timely release of funds will help policy makers fashion practical ways of enabling full financial and operational efficiency of the NHIS

This is a great piece of work which is well structured and thoroughly researched, providing an clear journey of the NHIS so far. From this research, it appears the scheme could be financially sustainable with the current sources of funding provided efforts are made to ensure consolidation of all earmarked funds, prompt releases of funds and further consideration on government fiscal policy reforms such as the capping of revenue. The scheme will be more sustainable if it is possible to decouple the NHIF from the consolidated fund and have all other revenue sources consolidated into a single earmarked revenue pool. This will reduce fragmentation and make it easier for management to make strategic purchasing decisions for the population as fragmentation in revenue pooling usually leads to fragmentation in purchasing of health services including delays in payment of claims.

Secondly, as these measures are being considered at the policy level to ensure adequate funding for the scheme, the NHIS being the single largest purchaser of health services in Ghana can leverage on immerging technology that improve its purchasing function through the tracking of service quality and checking provider-site moral hazards especially illegal payments. This will inspire confidence in the scheme and ensure population coverage as we make progress towards the attainment of UHC.

Congratulations Dan

Great points especially leveraging on technology to monitor service quality and billing of members will help to improve member experience.

The use of technology can make it easier to institute an award scheme to reward high performing service providers on an annual basis in a transparent manner. The providers can be given financial and non financial rewards. Publishing their names alone will serve as an advert for them to receive more patients, which will increase their revenue generation . This will ultimately have a trickling down effect and improve the overall service quality of the Scheme.

This article gives an in-depth analysis of the operations of NHIS. I’m particularly happy with the introduction of mobile renewal of membership and the fact that road accident victims are given some coverage under the scheme. A good information to all stakeholders. Congratulations

Respectfully, I write to add my comments to those already made by colleagues and very senior and highly respected health financing experts herein.

Dan, congratulation on this publication, and, for sharing your perspectives from the practitioner’s eye regarding domestic resource mobilization for health, with particular emphasis on Ghana’s NHIS.

Indeed, to guarantee the sustainability of the NHIS in the medium to long term, there is the need to look at: (a) revenue-side interventions – ensure timely release of NHIS funds for timely claims payments and seek additional inflows i.e. upward review of premium amount, special health tax on alcohol, sugar and related commodities; (b) expenditure-side interventions – re-focus on primary health care and reduce/eliminate fraud and abuse associated with manual processes through the use of technology and innovation; (c) supply-side intervention – leverage the Authority’s purchasing function to enforce the gatekeeper system/policy through strategic purchasing; and (d) demand-side intervention – leverage the Authority’s purchasing function through strategic purchasing to rollout payment arrangements that can deter insured members from self-referring themselves to higher facilities while ensuring that the poor and vulnerable are catered for.

Congrats once again Dan for this wonderful research work.

God bless us all.

Congratulations Dan for a comprehensive work done. This article indeed touches relevant issues affecting sustainability of Ghana’s National Health Insurance. I recommend amongst others, a vigorous and effective electronic system for claims submission to reduce or avoid over reimbursement and also system for monitoring the billing of services rendered to clients especially to check double billing ( billing both the clients and NHIA for the same services rendered yet, giving wrong impression to the client that NHIA doesn’t cover those services) to encourage more registration for membership for more premium and registration fees etc.

Well done Dan.

This is a wonderfully detailed and thought-provoking article, with useful lessons for future policy in Ghana, but also for all other countries who are considering earmarked funds for NHI / SHI. It appears that earmarked financing can help to strengthen the political and technical argument for setting up an NHI/ SHI fund. But the benefit of the NHI/ SHI fund will be undermined unless there is continued commitment to sustain the additionality principle – which requires, I guess, increasing the allocation of rising GDP to health through a broader set of revenue streams.

Thank you for nice information

Congratulations to the author for providing such a thorough practitioner’s review of one of the important social interventions implemented in Ghana and arguably, in Africa, the Ghana National Health Insurance Scheme.

The elaborate analysis and the highlights on the financial sustainability of the scheme from the standpoint of funding are critical for future reforms. In particular, the spotlights on the relative contributions to scheme from Internally Generated Funds (IGF) and earmarked public funds ( such as Value Added Tax and Social Security Contributions, etc.) is an important consideration for future reform.

The declining share of government expenditure on the health sector as a result of competing sectors is a critical concern policymaker should carefully consider for review of budgetary allocations to the health sector and subsequent reforms of the scheme. As observed by the author, the declining share of government expenditure could be indicative of a possible threat to the financial sustainability of the National Insurance Scheme. Policymakers need to pay critical attention to this.

Consistent with the suggestion of earlier commentators, I recommend that the funding sustainability adequately addressed by the author in this paper, should be considered together with other perspectives of sustainability during future reforms of the scheme. As argued by Sylvester Mensah, budgetary allocation to the scheme should be based on enrolment, the quality of the health delivery system, and accessibility. I also recommend effective financial controls to address the threats to sustainability emanating from outflows as observed by the author.

Very insightful and well written piece of research. I’ve learned a lot from it as it highlights the financial sustainability of the NHIS.

I think it would be great if the author can add after the conclusion some practical recommendations on how to improve the financial sustainability of the scheme: The following are some recommendations I would suggest after my review:

– NHIA, civil society and all stakeholders (service providers, general public etc) should advocate for the NHIS Levy to be transferred directly to the NHIA.

– NHIA, civil society and all stakeholders should advocate for the NHIS levy and SSNIT levy to be exempted from the capping system

I believe if these two recommendations are implemented, the NHIS will be more financially sound and the major issue of delay in payment to providers will be greatly reduced which will in turn improve the quality of service received by the scheme members.

The following suggestion will also help curb the bad practice of some healthcare providers billing patients to pay out of pocket and at the same time billing the NHIS:

My experience with private health insurance providers is that: anytime I visit the hospital and the hospital bills the insurance company, the insurance company sends me a text message/email indicating that the hospital has billed them xx amount for my healthcare service. For me this text message is a control mechanism for me to lodge a complaint to the insurance company if I was made to pay out of pocket before the hospital is again billing the insurance company to pay. I’m also able to lodge a complaint to the insurance company if the amount being billed by the hospital to the insurance company is unrealistic.

I think if the NHIS has such a system in place where patients can be sent a text message or email indicating how much the hospital is billing the NHIS for the services rendered and encourage patients to lodge a complaint if they suspect anything fishy that will help curb the issue of double billing or over-billing by some of the healthcare providers.

Also, the NHIS should intensify mystery shopping/mystery client as a monitoring mechanism to help detect some of the fraudulent practices undertaken by health providers and also ascertain the quality of services provided by the healthcare providers for redress.

Lastly, I think the NHIS should be innovative in their premium arrangements. Again my experience with private health insurance schemes is that: there are different premium schemes for different quality of services. Those who pay higher premium access higher quality healthcare services and those who pay the normal/minimum premium enjoy normal service package under the scheme. I believe if the NHIS adopt similar premium arrangement where those who can afford higher premium can pay to enjoy better quality services (i.e better quality health facilities, medications, wider disease coverage etc) it will offer the NHIS additional revenue. This arrangement will encourage the middle and higher income earners to patronize the NHIS as most of these people do not find the current NHIS scheme attractive enough due to the poor quality of service and the lack of opportunity to pay higher premium to enjoy higher quality service.

In conclusion, I will reiterate that this is a very insightful piece of research and I believe it will provoke discussions and ideas on how to improve the financial sustainability of the scheme. Good job.

Thank you James for all the useful suggestions especially having a system in place to promptly notify NHIS members of their medical bills after visiting a health facility so they could report any adverse observations for redress.

Congratulations Daniel on your in-depth and well researched publication.

Congrats Dan for such an educative well researched piece.

Congrats Dan for such an educative well researched piece.

Upon your persistent encouragement, i have decided to post this write-up entitled -“Achieving Financial Sustainability of the National Health Insurance Scheme in theCovid-19 Era” on the JLN Platform.

My hope is that it will add to the body of knowledge on sustainability available on the said platform.

Thanks a million for acting like the Chief Cupbearer of Pharaoh who remembered that there was a Joseph in prison who could interprete his Master’s dream